sales tax rate tucson az 85718

The 2018 United States Supreme Court decision in South Dakota v. View more property details sales history and Zestimate data on Zillow.

Arizona Income Tax Calculator Smartasset

When investment property is held for one year or less any gain on that sale is taxed at ordinary income tax rates.

. SOLD MAY 24 2022. For tax rates in other. The current total local sales tax rate in Tucson.

The Arizona sales tax rate is currently. This includes the rates on the state county city and special levels. The estimated 2022 sales tax rate for 85718 is.

For a more detailed breakdown of rates please refer to. Wherever possible we recommend holding investment property for more. The arizona az state sales tax rate is currently 56.

Tucson is located within Pima County ArizonaWithin. This includes the rates on the state county city and special levels. Tucson AZ Sales Tax Rate.

The sales tax jurisdiction. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817.

The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales tax consists of a 050 county sales tax and a 250. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

There is no applicable special tax. Nearby homes similar to 5450 E Craycroft Cir have recently. Tucson Az 85718 currently has 147 tax liens available as of September 3.

Get to know 85718. 4352 N Camino Real is. This is the total of state county and city sales tax rates.

The average cumulative sales tax rate in Tucson Arizona is 801. The County sales tax. 4352 N Camino Real is a 1425 square foot property with 3 bedrooms and 2 bathrooms.

Nearby homes similar to 5211 N Foothills Dr have recently sold between 600K to 1498K at an average of 320 per square foot. The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. We estimate that 4352 N Camino Real would rent between 1911 mo.

The estimated 2022 sales tax rate for zip code 85718 is 610. Sales tax and use tax rate of zip code 85718 is located in tucson city pima county arizona state. Has impacted many state nexus laws and sales tax collection.

The latest sales tax rate for Tucson AZ. The minimum combined 2022 sales tax rate for Tucson Arizona is. Sales tax and use tax rate of zip code 85718 is located in tucson city pima county arizona state.

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

7025 N Skyway Dr Tucson Az 85718 Mls 22209923 Redfin

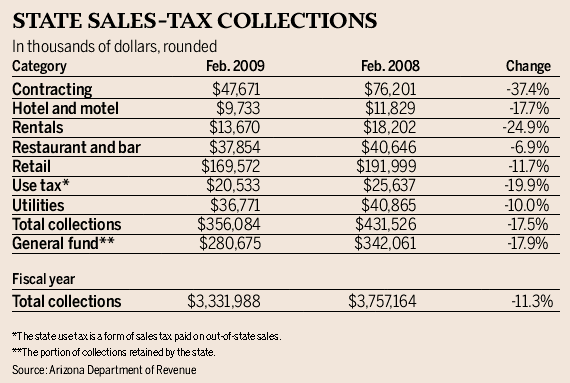

Arizona Sales Tax Collections Fell A Sharp 17 5 In February Business News Tucson Com

Sales Tax Rate Changes For 2022 Taxjar

5 Things You Need To Know About Sales Taxes In Quickbooks Online Virjee Consulting Pllc

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

7401 N Christie Dr Tucson Az 85718 Mls 22125219 Coldwell Banker

Arizona Solar Incentives Tax Credits For 2022 Leafscore

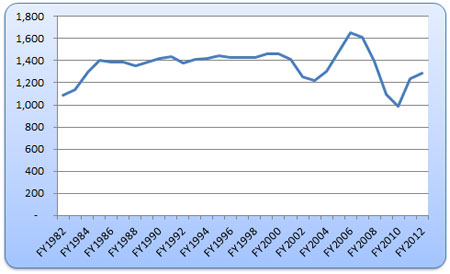

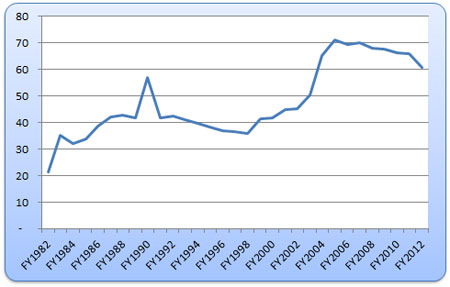

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

Arizona Sales Tax Rates By City County 2022

Arizona Sales Tax Small Business Guide Truic

5241 N Circulo Sobrio Tucson Az 85718 Realtor Com

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

How To Register For A Sales Tax Permit In Arizona Taxjar

5410 N Cabrillo Ct Tucson Az 85718 Mls 22221756 Zillow

Property Taxes In Arizona Lexology

Tucson Arizona Az Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Arizona Vehicle Sales Tax Fees Calculator Find The Best Car Price

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy